Article | Feb 2017 | Family Business Magazine

Family Business Compensation: The Advantages and the Challenges

Family businesses have unique challenges in attracting, retaining, and motivating outside executive talent—here are some strategies to consider.

As a private, family-controlled company matures, it faces complex business challenges if it is to continue on a profitable growth trajectory through future generations. One of the major challenges is recruiting, retaining, and engaging outside executive talent. In addition, the current executive team must be compensated in a manner that encourages continued value creation and maximizes the compensation investment.

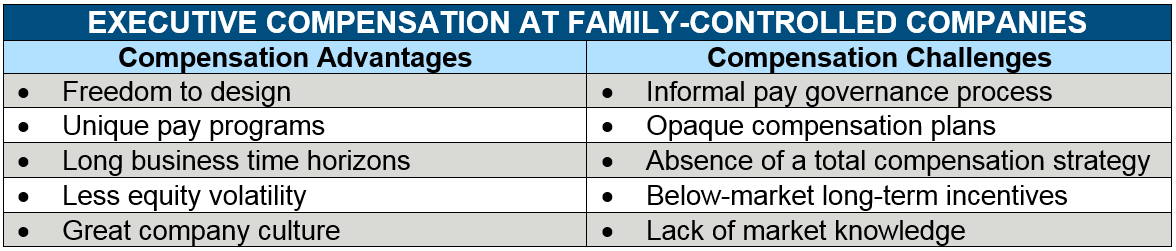

Executive compensation is an area that can either help facilitate the development of the leadership team and encourage generational transition, or serve as a barrier to continued business growth. Family companies must capitalize on their competitive advantages, while mitigating the most common challenges.

Compensation Advantages

When competing for talent in the executive labor market, family companies have several inherent executive compensation advantages to help attract, engage, and retain executive talent.

- Freedom to design: Family companies, especially those that are private, have the freedom to design and structure executive compensation in any way that the owners believe is optimal for the business. Unlike public companies, private companies are not under the microscope of institutional shareholder advisers and investors with short time horizons. These outside forces exert extreme pressure on public company boards to offer plain-vanilla, one-size-fits-all executive compensation plans and often base their recommendations on simple checklists. Programs and features that are outside the market norm are red-flagged, sometimes solely for being different. The result is a continued homogenization of executive compensation programs in the public market that does not necessarily serve the needs of each company. Private firms, by contrast, can design programs more strategically.

- Unique pay programs: Given this freedom from public scrutiny, family-controlled entities often have unique compensation programs. In many cases, the plans were developed by founding family members and have become part of the fabric of the culture. Often these programs have nuances and features that one would not find at a public company, such as innovative deferred compensation plans, long-term incentive plans based on economic value drivers, and internal stock valuations insulated from the vagaries of the public stock market. These differentiated and unique pay programs provide family-controlled companies with a potential competitive advantage over increasingly generic plans at public companies.

- Long time horizons: Family companies have naturally long-term perspectives on the business. There is a sense of history and legacy as ownership is passed down through generations. This long-term view stands in stark contrast to a public company, where there is enormous pressure to meet quarterly earnings-per-share targets. This extended perspective at family companies provides the leadership with more flexibility to develop and execute a long-term business strategy. From an executive compensation standpoint, pay plans may be designed in a manner that rewards true long-term success of the enterprise. For example, a 2015-2016 survey of private family business boards by the National Association of Corporate Directors showed that almost 50% of respondents considered a time horizon greater than three years for executive performance plans, in contrast to the almost universal three-year period for public companies.

- Less equity volatility: Private, family-controlled companies are more insulated from the rollercoaster ride of the public stock markets. Many private family companies offer some form of long-term incentive tied to the value of the business, which may be an actual stock interest, phantom stock or some other form of long-term reward based on the value of the private equity. This private valuation is not subject to the manic behavior of the public equity markets, making it a more stable basis for long-term compensation.

- Great company culture: Family-controlled entities can offer a very attractive company culture. For many senior executives, the family culture is a refreshing contrast to the bureaucracy and politics that all too often exist in public companies. In fact, strong corporate culture is a key reason that family businesses often top the lists of “best places to work.” These companies can foster tremendous executive loyalty. Many executives choose to stay with family firms for reasons well beyond compensation.

Compensation Challenges

Despite these significant competitive advantages when it comes to executive compensation, privately owned family firms also face several common compensation challenges.

- Informal pay governance process: Compensation governance in private family firms tends to be a bit more informal and less structured than in public companies. According to the NACD family business board survey, about 72% of companies have a compensation committee, which typically meets four times per year. However, there is often less clarity around the purview of the committee, and its compensation decision rights and meeting agendas may be more fluid than in the public realm. Also, the committee usually consists of family shareholders and insiders, rather than independent directors. In a public company, stock exchange listing rules require an independent committee. When insiders serve on a compensation committee, executive pay discussions can be more personal and potentially contentious.

- Opaque compensation plans: Many family companies offer unique compensation programs, but these programs are sometimes opaque and not fully understood by all stakeholders. Overall, executive compensation is not subject to the same transparency as in a public company; there is no requirement to summarize the programs in an annual proxy statement. Thus, obscure features of the compensation plan may persist, and executives may lack a complete understanding and appreciation of the value of the total package. In such cases, the company may be failing to maximize the return on investment of the compensation program. Indeed, the compensation committee itself may not fully understand the plans.

- Below-market long-term incentives: In most instances, private companies will offer long-term incentives that are well below market compared with those offered by public companies. There are numerous reasons why family companies offer below-market long-term incentives. These reasons include the family’s unwillingness to share equity and thus dilute both ownership and earnings. Thus, it is often unrealistic for a private family company to match the long-term incentive compensation levels offered by public companies, and the total compensation strategy must consider this shortfall.

- Absence of a total compensation strategy: Family companies often lack a cohesive compensation strategy covering all elements of executive pay: base salary, annual incentive, long-term incentives, and benefits/ perquisites. The company leaders may not understand how all of the elements of pay fit together as well as the trade-offs between various elements. Further, while family culture can be a significant competitive advantage, there is a downside to the culture as well. At the extreme, the family company may find itself leaning too much on the culture and goodwill of executives, believing that loyal, long-tenured executives are less concerned about compensation. In some cases, the owners erroneously believe that company culture offsets any competitive shortfalls in compensation.

- Lack of external market knowledge: Private family companies often lack an understanding of current market practices and norms. Small companies place less emphasis on the external labor market. They tend to promote executive talent from within the company, until that is no longer tenable. A lack of knowledge about executive compensation trends can hinder the ability to compete for talent. Just as a family company should not ignore its competitors’ business practices, it is not advantageous to put one’s head in the sand and ignore market practices for executive compensation. As with everything in business, “ignorance is not bliss.”

Considerations

How can family-controlled companies better capitalize on these competitive advantages and address these common pay challenges?

- Refine the executive pay governance process: Family companies should customize the governance process to fit the board structure and culture. Typically, the pay governance process will be a bit more informal than in a public company, but several best practices can be adopted. These include clarifying the committee’s purview, defining decision rights, and establishing a calendar of events and a predictable annual agenda. Furthermore, the committee should monitor market practices, including trends in executive pay levels, plan design, and technical issues (e.g., tax, accounting, and the SEC).

- Study the specifics: Executive leadership and the compensation committee should seek to fully understand the details of the company’s pay programs. This includes all elements of total compensation. Further, the committee should be familiar with current market practices of comparable private and public companies. The committee should recognize how the company’s practices differ from market and what makes the compensation value proposition unique. There is no benefit to be gained by having one’s head in the sand.

- Develop a realistic total compensation strategy: Family companies must articulate a thoughtful but realistic compensation strategy. Armed with quality information about the company’s own pay programs and the market, the business leaders are in much a better position to set a total compensation strategy—one that is realistic, customized to the company culture, and based on compensation realities. The strategy should go beyond simple platitudes such as “be market competitive.”

- Better communicate compensation programs: Family-controlled companies must do a much better job of communicating the executive compensation “deal.” Companies must make their unique—but often opaque—compensation programs more transparent. Executives should be aware of and appreciate the total economic value of all pay elements. In addition, they must fully grasp the concept of incentive plans in order for these incentive plans to actually influence executive behavior. Finally, compensation committees themselves must understand total compensation programs in order to make informed, rational pay decisions.

Winning the War for Talent

Executive compensation can be a challenging issue in the family enterprise. However, just as the business must evolve to continue profitable growth, so must the executive compensation system. With some careful planning and structure, family-controlled companies can manage executive compensation in a manner that addresses the most common challenges, while maximizing their inherent competitive pay advantages. This will enable them to build the right teams that can advance the long-term growth strategy of the business at the same time.